A ‘Pharmacy First’ system where chemists handle minor ailments with insurance coverage reduces burden on hospitals, provides quick, convenient care to patients.

A young mother, let’s call her Akinyi, walks into a small, bustling pharmacy in Kawangware, her feverish two-year-old son, Ken, clinging to her leg. She bypasses the long queues at the nearby public clinic and heads straight for the pharmacist, a familiar face in the community, the first point of contact with the health system.

Akinyi hands over her son’s prescription alongside her private health insurance card, which she pays for monthly premiums.

But the pharmacist, with a sympathetic but firm expression, says softly. “We cannot accept this here. You will have to pay cash.”

The medicine costs Akinyi Ksh1,500, a significant chunk of her daily earnings in a daily reality that exposes a gaping hole in Kenya’s healthcare system: the widespread unavailability of health insurance services in places patients first seek care.

It is a paradox, as the “first contact” is also a financial dead-end, whether you have public or private insurance.

While the implementation delays of the mandatory Social Health Insurance Fund (SHIF) are a major factor, the problem of health insurance not being accepted in pharmacies is a far more complex, tangled mess of economics and mistrust.

The “Preferred Provider” Problem: Private insurers operate on a model of “preferred providers,” a curated list of health facilities with whom they have negotiated service agreements. Pharmacies, especially standalone community ones, are often not on this list. Insurers dictate where patients can seek care, which tests they can get, and which drugs they can receive, all to control costs. This rigid system undermines the very essence of a community pharmacy, its accessibility and convenience.

Low Reimbursement and High Rejection Rates: From a pharmacist’s perspective, dealing with insurance companies can be a financial and administrative nightmare. Many private insurers offer reimbursement rates for medication that are far below the market rate, forcing pharmacies to sell medicines at a loss. Furthermore, claim rejections are rampant, often due to minor administrative errors. A single missing signature or an incorrect date on a prescription can nullify a claim, leaving the pharmacy with an unpaid bill. This forces many pharmacists to adopt a cash-only policy to avoid the financial risk and administrative burden.

Cash Flow and Fraud Concerns: For a small business, a two-to-three-month reimbursement cycle, as is common with many insurers, can cripple cash flow. Pharmacies need a constant stream of income to restock shelves and pay staff. The risk of delayed payments or outright rejection makes accepting insurance a non-viable business model for many. Additionally, insurers are wary of fraud and over-prescription, leading them to erect bureaucratic walls that hurt legitimate businesses and patients in equal measure.

The old National Hospital Insurance Fund (NHIF) system was a prime example of lack of transparency regarding changes to drug lists and benefit packages. This poor communication saw claims being rejected without a clear reason, creating a frustrating cycle of confusion for both the retailer and the patient.

Kenyans instinctively turn to pharmacies for minor ailments and immediate needs. Pharmacies are ubiquitous, easily accessible, and often less intimidating than a crowded public hospital. They are the frontline of healthcare, offering quick advice, over-the-counter medications, and a sense of community trust.

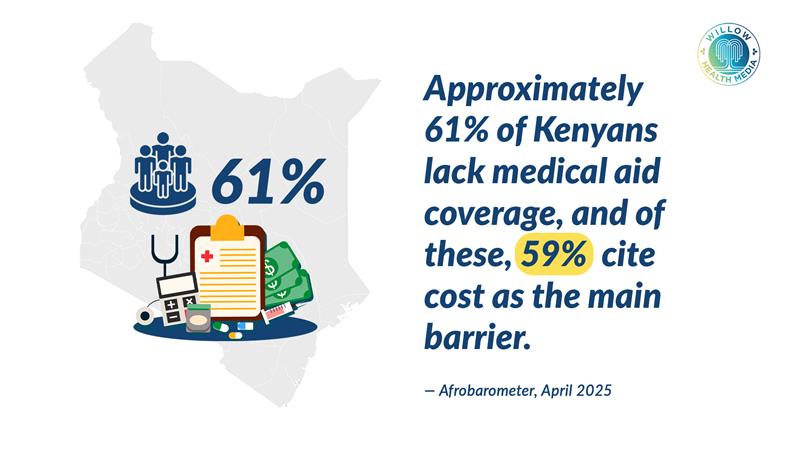

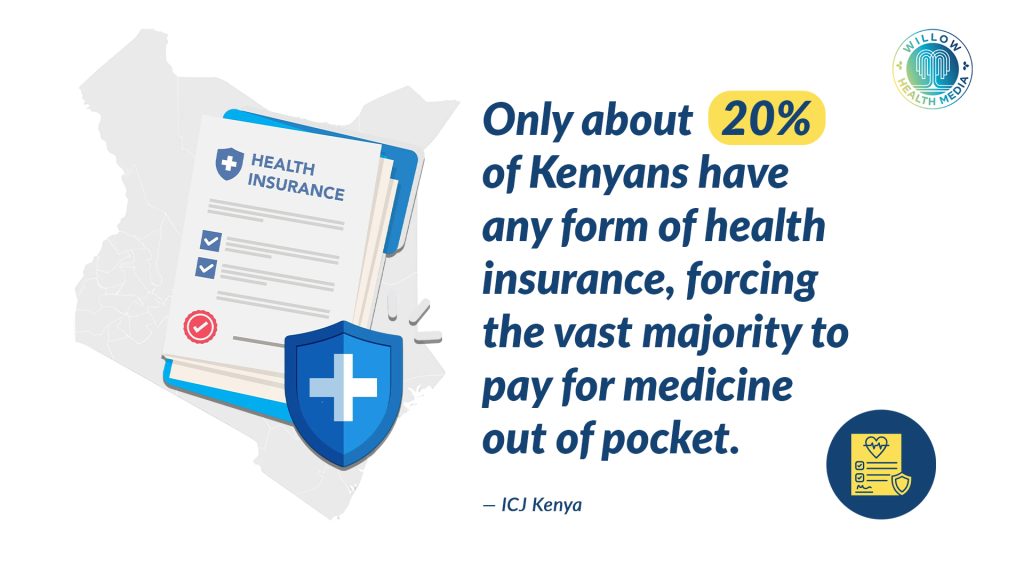

But right now, the new Social Health Insurance Fund (SHIF) is barely accepted at most pharmacies. Private insurance covers some pharmacy costs, but it’s too expensive for most people. The result? Only about one in five Kenyans (or 20 per cent of the population) have any health insurance at all, forcing the vast majority to pay for medicine out of their own pockets. This creates the ‘Paradox of the First Contact’, which is the pharmacy where your insurance card is not useful!

Then come the challenges from the pharmacy owner’s perspective. Let us consider Mr. Otieno, who owns a pharmacy in Kisumu. He knows his customers are aware of health insurance, and he sees real value in being certified to accept it.

This certification helps him attract more business and allows his clients to afford critical, life-saving drugs that would otherwise be too expensive. He says the process to get certified has gotten easier, and he’s happy that insurance payments are usually processed and sent to him within two to three months.

By the time pharmacies get paid, the cost of the medicine has already gone up

However, the biggest headache is the high claim rejection rate over missing signatures, wrong dates or incorrect drug dosage: The system requires a perfect match between the paper and the electronic prescription. One small error and the claim is rejected, while reimbursement prices for medicines set by insurance companies are often below the market rate, forcing pharmacies to sell at a loss.

The price list is not updated often enough; by the time pharmacies get paid, the cost of the medicine has already gone up. This financial squeeze is a major disincentive for pharmacies to embrace public insurance schemes, creating a vicious cycle of limited access and frustrated patients, according to a study titled, National Health Insurance Fund’s Relationship to Retail Drug Outlets and carried out in Tanzania by researchers led by Martha Embrey.

The study, published in the 2021 Journal of Pharmaceutical Policy and Practice, mirrors goings on in Kenya where fraud prevention mechanisms- requiring a meticulous, and often impossible, reconciliation between paper and electronic prescriptions- were a major source of headache.

This is not a blame game, but a systemic problem. The general reliance on private pharmacies for medication, even when they are not integrated with insurance schemes, underscores a patient-centric system that often prioritises private facilities over public ones for speed and convenience. But this convenience comes at a high financial cost, which disproportionately affects low-income families and those in the informal sector.

‘Pharmacy First’ model reduces burden on hospitals, provides quick, convenient care

But the vision of a “Pharmacy First” system, where pharmacies are fully integrated into the healthcare network and can handle minor ailments with insurance coverage, is not a futuristic fantasy.

Already, Old Mutual and Britam are pioneering this model. Their “Pharmacy First” services allow members to get treatment for common conditions like colds, flu, and UTIs directly from a certified pharmacy without needing a doctor’s visit first.

This model reduces the burden on hospitals, provides quick and convenient care, and empowers patients. But the reach of these private insurers is still minimal, and the challenge is to scale it to a national level, making it the norm rather than the exception.

Making a “Pharmacy First” system a reality requires a multi-pronged approach involving the following:

Standardised Digital Platforms: The current system is fragmented. A single, unified digital platform for all insurers, public and private, is essential. This system would enable real-time claim submission and verification, cutting administrative errors and speeding up reimbursements. Replacing paper prescriptions and manual work would drastically reduce claim rejections. Tools like “Maisha Meds” software show how pharmacy management systems can collect data to support national policy.

Incentivising Pharmacy Partnerships: Insurers should be encouraged to include more community pharmacies in their networks. This could be achieved through government mandates or tax incentives for those with broad pharmacy coverage. Contracts must also offer fair, regularly updated reimbursement rates to make partnerships sustainable for pharmacists.

Tiered Insurance Products: Kenya’s large informal sector remains mostly uninsured. Insurers should create affordable, tiered micro-insurance plans. Using mobile money platforms like M-Pesa, people could pay in small, frequent instalments, making insurance manageable and dramatically expanding coverage.

Strengthening Prescribing Practices: High claim rejection rates stem from poor coordination between health facilities, pharmacies, and insurers. Training prescribers on proper documentation is critical. A strong feedback loop between insurers and pharmacies would also help resolve issues quickly and improve efficiency.

Data-Driven Policy Making: Better data is needed to shape effective health policy. A centralised database tracking dispensed medicines and rejected claims would reveal disease trends, medicine shortages, and system bottlenecks. This evidence allows for informed, responsive decision-making.

The community pharmacy is more than just a place to buy medicine; it is a pillar of primary healthcare. By addressing the systemic flaws that currently exclude them from the insurance ecosystem, we can transform the health and well-being of millions of Kenyans. The goal is not just to have insurance, but to have insurance that works when you need it most.

Dr Madline Iseren is a Pharmacist and Essayist.